Powerful 5 Banks in Central African Republic:Online Banking Services

A Brief History of Major Banks in the Central African Republic

BGFI Banque Centrafrique (BGFI): BGFI Bank was established in the Central African Republic (CAR) as part of the broader BGFI Bank Group, a leading financial institution in Africa. Founded in 2000, the bank focuses on offering a range of services including corporate banking, investment solutions, and retail banking. BGFI Banque Centrafrique plays a significant role in facilitating economic development in the country, contributing to growth across industries and improving access to banking services for individuals and businesses.

Banque Internationale pour le Centrafrique (BICA): Banque Internationale pour le Centrafrique, founded in 1992, has become one of the country’s key financial institutions. Originally established to serve both individual and corporate clients, BICA offers a variety of services, including savings accounts, loans, and international banking solutions. The bank has grown its customer base over the years and remains an essential player in CAR’s banking sector, supporting the financial needs of both citizens and businesses.

Banque Populaire Maroco-Centrafricaine (BPMC): Founded in collaboration with Moroccan financial institutions, Banque Populaire Maroco-Centrafricaine (BPMC) was created to foster trade and financial relations between Morocco and the Central African Republic. BPMC specializes in offering retail and corporate banking services, including personal loans, savings accounts, and investment solutions. It has played a crucial role in enhancing cross-border economic cooperation and strengthening financial ties between the two nations.

Commercial Bank Centrafrique: Commercial Bank Centrafrique is a subsidiary of the Commercial Bank Group and has been operating in the Central African Republic since 2001. The bank is known for its focus on commercial and corporate banking, providing tailored financial solutions for businesses, as well as retail banking services for individuals. Its commitment to innovation and customer satisfaction has made it a leading player in the country’s financial industry.

Ecobank: Ecobank entered the Central African Republic’s banking market in 2008 as part of its broader pan-African strategy. It has since established itself as a leading bank in the country, offering a wide range of services, including retail banking, corporate banking, and trade finance. Ecobank’s mission is to promote financial inclusion and connect CAR’s economy with other African nations, supporting businesses and individuals with efficient and modern banking solutions.

Here are incoming links you can use for this article to provide additional context or references:

- BGFI Banque Centrafrique (BGFI): To learn more about BGFI Bank’s expansion in Africa, visit BGFI Group’s official site.

- Banque Internationale pour le Centrafrique (BICA): For further insights into BICA’s role in the Central African Republic’s banking sector, check out this resource.

- Banque Populaire Maroco-Centrafricaine (BPMC): For more details on BPMC’s partnership with Morocco, visit the Banque Populaire website.

- Commercial Bank Centrafrique: Discover more about Commercial Bank Centrafrique’s services and business solutions by visiting the Commercial Bank Group.

- Ecobank: To explore Ecobank’s pan-African reach and its services in CAR, check Ecobank’s website.

How to Open a Savings Account, Apply for a Loan, and Credit Card in Central African Republic Banks

If you’re looking to open a savings account, apply for a loan, or obtain a credit card in the Central African Republic (CAR), here’s a step-by-step guide for each process across major banks. We’ll also provide details on IFSC (Indian Financial System Code) and SWIFT codes for banks in CAR, where relevant.

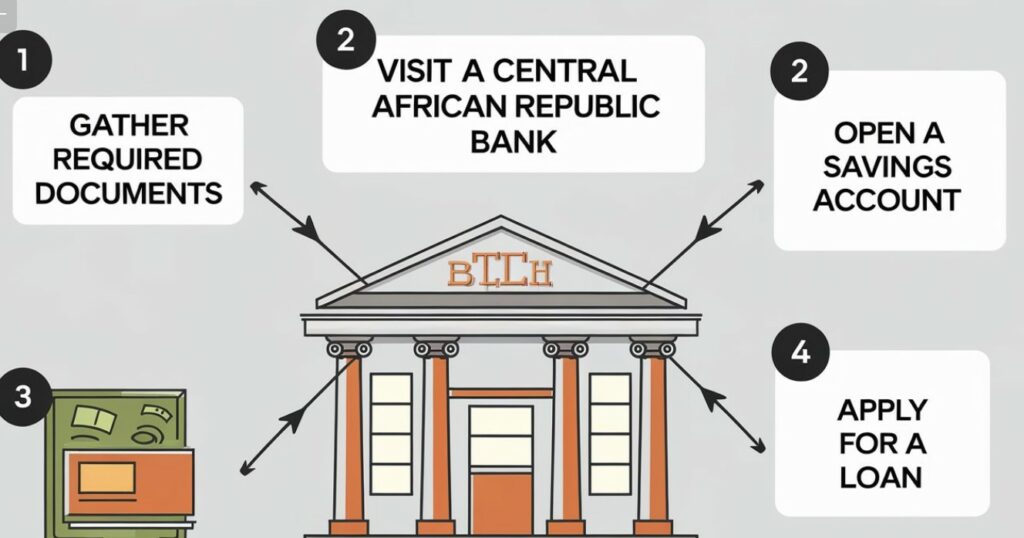

1. How to Open a Savings Account in Central African Republic Banks

Opening a savings account in the Central African Republic is a straightforward process across all major banks, including BGFI Banque Centrafrique, Banque Internationale pour le Centrafrique (BICA), Commercial Bank Centrafrique, and Ecobank.

Steps to Open a Savings Account:

- Step 1: Visit the nearest branch of your preferred bank or access their official website (if available) to begin the application process.

- Step 2: Provide required identification documents, which typically include a valid ID or passport, proof of residence, and sometimes a tax identification number.

- Step 3: Fill out the savings account application form, which can be done online or in person.

- Step 4: Deposit the minimum opening balance, which varies depending on the bank. This could range from a few dollars to a higher amount, depending on the account type.

- Step 5: Once your application is processed, you’ll receive your account details, passbook, and/or debit card.

2. How to Apply for a Loan in Central African Republic Banks

Applying for a personal or business loan in the Central African Republic follows similar guidelines across the banks.

Steps to Apply for a Loan:

- Step 1: Research and choose a bank offering the loan type you need (personal, business, mortgage). Most major banks like Commercial Bank Centrafrique and Ecobank offer various loan options.

- Step 2: Visit the bank’s loan department or website to gather details on loan eligibility, interest rates, and repayment terms.

- Step 3: Submit the necessary documents, which usually include proof of income, identification, bank statements, and sometimes a business plan (for business loans).

- Step 4: Fill out the loan application form, either in person or online.

- Step 5: Await approval. The bank will evaluate your financial stability, credit score, and ability to repay the loan. This process can take a few days to a few weeks.

- Step 6: Upon approval, the loan amount will be disbursed to your account, and you will start the repayment process as per the agreed terms.

3. How to Apply for a Credit Card in Central African Republic Banks

Credit cards are becoming more common in the Central African Republic, with banks like Ecobank and BGFI offering tailored card solutions to their customers.

Steps to Apply for a Credit Card:

- Step 1: Choose a bank that offers credit cards. BGFI and Ecobank are some of the banks that provide credit card services in the CAR.

- Step 2: Visit the bank’s website or branch to check the eligibility criteria, which typically include proof of income, age requirements, and a savings or current account with the bank.

- Step 3: Fill out the credit card application form, providing necessary documents such as income proof, ID, and bank statements.

- Step 4: Once your application is processed and approved, you will receive your credit card. The approval time can vary, but it generally takes a few business days.

- Step 5: Activate the credit card by following the bank’s instructions, and you can start using it immediately.

4. IFSC and SWIFT Code Details for Banks in the Central African Republic

In the context of international transactions, knowing the bank’s SWIFT code is essential for wire transfers, especially for receiving money from overseas.

- SWIFT Code: Banks in the Central African Republic use the SWIFT system for international transactions. Each bank has its unique SWIFT code for identifying branches during global transactions.

- BGFI Banque Centrafrique: BGFIGAEXXXX

- Ecobank Central African Republic: ECOCCMCXXXX

- Commercial Bank Centrafrique: COMACMCXXXX

- Banque Internationale pour le Centrafrique (BICA): BICACMCXXXX

- IFSC Code: The IFSC code is mainly used for Indian banks and does not apply directly to Central African Republic banks. However, if you are conducting transactions between India and CAR, you will use the SWIFT code for international transfers.

How to Reach and Contact Major Banks in the Central African Republic

1. BGFI Banque Centrafrique (BGFI)

- Phone: +236 21 61 90 90

- Email: info@bgficf.com

- Website: BGFI Banque Centrafrique

- Head Office: Avenue Moussa Tavele, BP 508, Bangui, Central African Republic

- Social Media: BGFI Banque Centrafrique may also be available on LinkedIn and Facebook for updates and customer service.

2. Banque Internationale pour le Centrafrique (BICA)

- Phone: +236 21 61 30 40

- Email: bica@bica.org.cf

- Website: Banque Internationale pour le Centrafrique

- Head Office: Avenue de l’Indépendance, Bangui, Central African Republic

- Customer Support: For detailed inquiries, visit their website or contact them via email for assistance.

3. Banque Populaire Maroco-Centrafricaine (BPMC)

- Phone: +236 21 61 20 00

- Email: contact@bpmc.cf

- Website: BPMC

- Head Office: Avenue de la République, Bangui, Central African Republic

- Customer Service: For support and more information, you can visit their website or contact their main office directly.

4. Commercial Bank Centrafrique

- Phone: +236 21 61 31 00

- Email: info@commercialbank-group.com

- Website: Commercial Bank Centrafrique

- Head Office: Avenue Moussa Tavele, BP 674, Bangui, Central African Republic

- Customer Support: For queries and assistance, use their official website or contact the head office via phone or email.

5. Ecobank

- Phone: +236 21 61 36 00

- Email: ecobank@ecobank.com

- Website: Ecobank Central African Republic

- Head Office: Boulevard Tchad, Bangui, Central African Republic

- Customer Service: Ecobank offers extensive customer support through their website, including contact forms and online chat options.

Also Read

- Top 16 Comprehensive Banks in Armenia: Opening Accounts and Exploring Loans

- Top 25 Banks in Angola: Opening Savings Accounts and Exploring Loan Options

- The Top 7 Banks in Andorra: Powerful Choices for Your Savings and Loan Needs

- 22 Powerful Banks in Algeria: Comprehensive Guide to Savings Accounts and Loans

- Top 9 Powerful Banks in Albania: Comparing Features and Services

- Top 8 Banks in Afghanistan : Online and Offline Guide for Open a Savings Account

- Top Banks in Australia: Savings Accounts, Loan Options, and Contact Information

- Top 50 Savings Accounts Banks in Austria: Opening Accounts and Exploring Loans

- https://facultytalkies.com/2024/09/azerbaijans-leading-23-banks/

- https://facultytalkies.com/2024/09/top-53-savings-accounts-banks-in-bahrain/

- https://facultytalkies.com/2024/09/top-30-powerful-banks-in-bangladesh/

- https://facultytalkies.com/2024/09/powerful-21-top-banks-in-belarus/

- https://facultytalkies.com/2024/09/top-32-banks-in-benin/

- https://facultytalkies.com/2024/09/power-ful-7-banks-in-bhutan/

- https://facultytalkies.com/2024/09/ultimate-list-of-22-leading-banks-in-bosnia-and-herzegovina/

- https://facultytalkies.com/2024/09/discover-the-8-most-prominent-banks-in-botswana/

- https://facultytalkies.com/2024/09/complete-directory-of-77-powerful-banks-in-brazil/

- https://facultytalkies.com/2024/09/find-the-top-powerful-12-banks-in-brunei/

- https://facultytalkies.com/2024/09/powerful-32-leading-banks-in-bulgaria/

- https://facultytalkies.com/2024/09/the-23-most-influential-banks-in-burkina-faso/